With 2024 right around the corner, the IRS recently announced several contribution limits for retirement accounts as well as increased thresholds for income tax

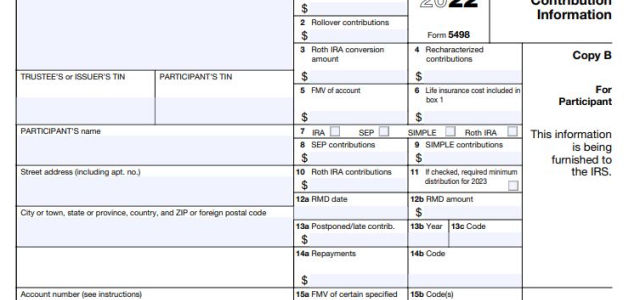

You may have received a 2022 Form 5498 from the IRS this month, after the tax filing deadline. Each year Form 5498 is issued in May. Form 5498 is an

With 2023 right around the corner, the IRS recently announced several contribution limits for retirement accounts as well as increased thresholds for income tax

One of the most common questions raised when talking about retirement is ‘Will I run out of money?’ Many retirees have looked to the “4% rule” for guidance. In

Adjusted Gross Income (AGI) is an important line on a tax return which affects taxes owed. Common deductions are taken to arrive at this figure, e.g., IRA

Downturns in the stock market can be met with some level of concern. An experienced investor knows the last thing to do would be to sell everything and exit the

A common tax savings strategy for investors is to intentionally sell securities with losses to offset gains that have been realized or will be realized in the

Under normal circumstances, withdrawing funds from IRA or qualified retirement plans (e.g., 401(k), 403(b), 457, etc.) before the age of 59 ½ will result in a

Job satisfaction/dissatisfaction, age differences, personal preferences, etc. are valid reasons why you would choose to retire earlier than your spouse. Doing

With 2022 right around the corner, several increased income/tax limits have been released that may affect you. Below are the highlights:

Qualified Retirement

Back in April, the Biden Administration proposed numerous changes to the tax code which underwent various changes in the legislative text and is being debated

Large or small, every donation counts towards doing good. Depending on either your financial situation and/or overall charitable inclination, you may have a