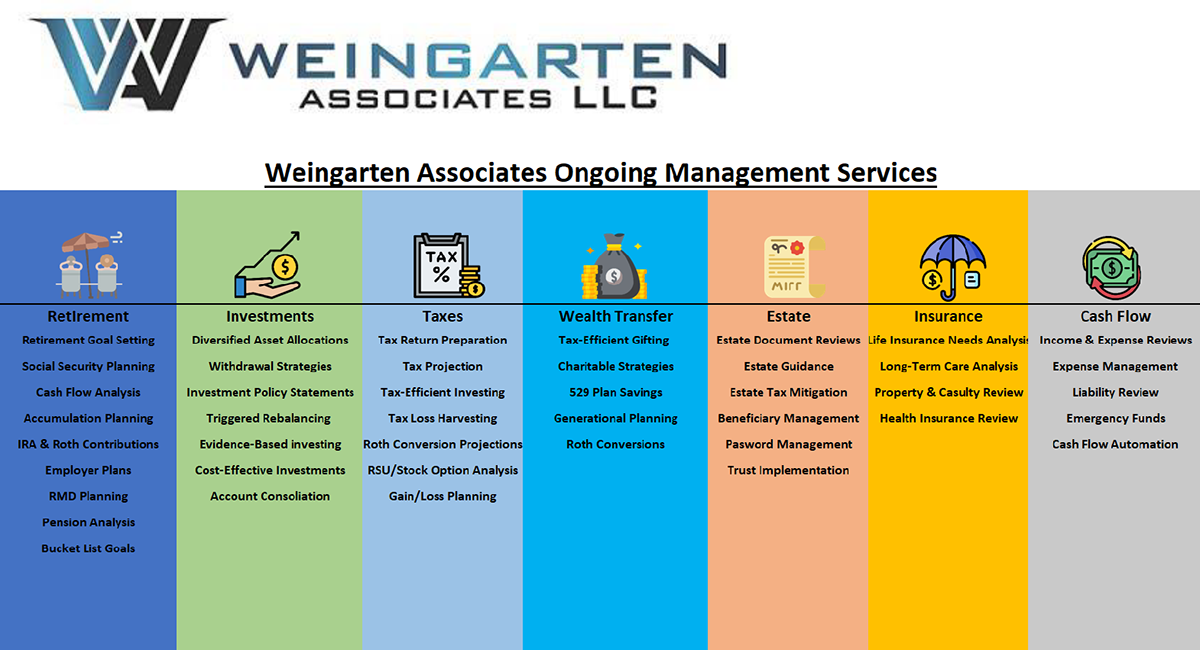

Below is a sample of some of the services we have provided to our clients

Disclaimer

While Weingarten Associates has helped clients with the above services, we make no guarantee to provide each of these services to every client. All client services are customized to your unique needs. We also make no guarantee as to future investment performance or returns.